SEP IRAs and straightforward IRAs also have further principles comparable to These for experienced strategies governing how contributions can and needs to be designed and what workforce are certified to take part.

You'll want to seek to add the utmost amount towards your IRA each and every year to get the most out of such price savings. Even making smaller contributions to the IRA after some time will help.

An illustration of these profit would be the use of the real-estate given that the owner's private residence, allowing a mum or dad to reside in the property, or making it possible for the IRA account owner to repair a leaky toilet. The IRS specially states that custodians may impose their own personal policies earlier mentioned the rules imposed from the IRS.[14] Neither custodians nor directors can offer advice.

Conserving up for retirement may help individuals Be sure that when they quit Functioning, they’ll have enough dollars to Stay easily.

A backdoor Roth IRA is undoubtedly an investing system that takes advantage of an IRS tax loophole to permit higher-money earners to accessibility Roth IRAs. To simplify a to some degree intricate procedure, this system demands opening a standard IRA, funding the account and instantly executing a Roth conversion.

Many thanks for subscribing! Check out your Favorites webpage, in which you can: Tell us the topics you need To find out more about

Roth IRA Roth IRA contributions will not be tax-deductible from the 12 months by which you make them. Even so the distributions are tax-free. Meaning you contribute to a Roth IRA using just after-tax pounds and pay back no taxes, even in your investment gains.

We do not give economic information, advisory or brokerage expert services, nor will we propose or suggest men and women or to buy or offer specific shares or securities. Functionality data could have altered Considering that the time of publication. Earlier effectiveness isn't indicative of foreseeable future success.

A rollover IRA is surely an IRA funded with cash from a previous employer-sponsored 401(k) that doesn’t incur early withdrawal penalties.

Explore extra morena bucetão money managementSaving moneyHandling expenses and expensesShoppingFinancial healthSavings goal calculatorNet worthy of calculator

) As being the account holder, it is possible to opt for If you prefer a hands-on strategy by selecting your own private investments or if you would like to generally be arms-off and Allow Many others, for instance a robo-advisor or economical planner, do the be just right for you.

A rollover IRA is simply a standard IRA that somebody results in working with money from an aged retirement system. A standard instance is someone who leaves their job but contains a 401(k) with that employer.

Publicly traded securities such as options, futures or other derivatives are authorized in IRAs, but specific custodians or brokers may well limit their use. As an example, some selections brokers allow their IRA accounts to carry inventory solutions, but Other folks will not. Employing specified derivatives or investments that require leverage could possibly be allowed via the IRC, it may additionally cause the IRA to pay taxes underneath the policies of Unrelated Company Money Tax (UBIT).

The principles with regards to IRA rollovers and transfers allow the IRA operator to carry out an "indirect rollover" to another IRA. An indirect rollover can be utilized to briefly "borrow" funds from your IRA, once inside of a twelve-month period.

Daniel Stern Then & Now!

Daniel Stern Then & Now! Richard "Little Hercules" Sandrak Then & Now!

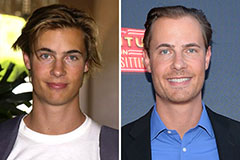

Richard "Little Hercules" Sandrak Then & Now! Erik von Detten Then & Now!

Erik von Detten Then & Now! Susan Dey Then & Now!

Susan Dey Then & Now! Batista Then & Now!

Batista Then & Now!